Standoff or Faceoff

The pressures on Donald Trump....

1. International markets overnight dropped heavily, as all expect a third straight day of massive selling in the U.S.

2. Most elites in the U.S. and around the world believe we are witnessing an historically misguided plan, poorly executed, by incompetent people. Some of those elites claim that if the plan were being put in place skillfully by senior officials who were acting in a manner that inspires confidence, they would feel differently. But that is a counterfactual which is currently meaningless. No one expects better execution or different people.

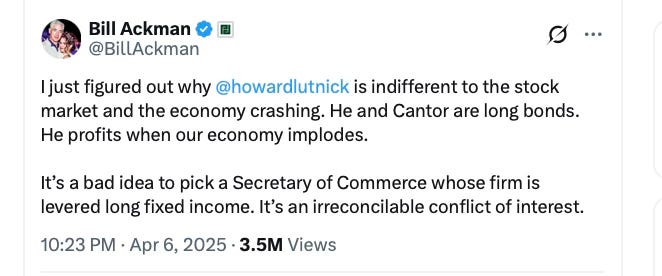

3. Macron is not alone in believing that what is being done is “brutal and unfounded.” You can add to the list nearly every trader, investor, and builder in my X feed, Elon Musk (or so it seems…), Paul Gigot, Ben Shapiro, and a new band leader, Bill Ackman, who wants (but will not get) a 90-day pause in the tariff policy:

And/but also, per the Wall Street Journal:

Howard Marks, co-chairman of investment firm Oaktree Capital, said in an interview on Bloomberg Television. “We’ve gone from free trade and world trade and globalization to this system, which implies significant restrictions on trade in every direction and a step toward isolation for the United States.”

Stan Druckenmiller, the investor and lifelong Republican who was Treasury Secretary Scott Bessent’s boss at George Soros’s hedge fund, sent a rare post on X, making clear his opposition to the administration’s tariff plan: “I do not support tariffs exceeding 10%.”

Hedge-fund manager Dan Loeb pointed to Druckenmiller’s and Marks’s comments on his X feed. He said there were conceptual and practical errors in the policy announced last week, adding, “It will be a test of the administration’s judgment versus ideology how they resolve this over the weekend or coming days.”

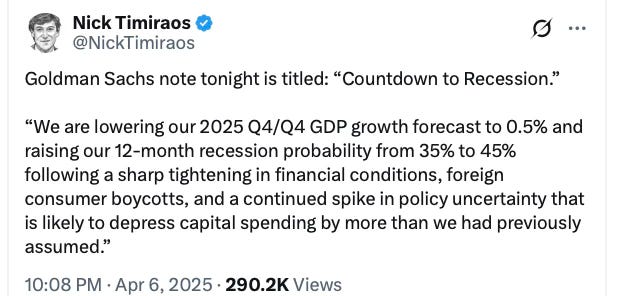

4. After the U.S. markets plunge today, there will be even more talk of both recession and 2007-2008 echoes:

In conversations with The New York Times over the weekend, bankers, executives and traders said they felt flashbacks to the 2007-8 global financial crisis, one that took down a number of Wall Street’s giants. Leaving out the brutal, but relatively short-lived market panic that erupted at the start of the coronavirus pandemic, the velocity of last week’s market decline — stocks fell 10 percent over just two days — was topped only by the waves of selling that came as Lehman Brothers collapsed in 2008.

5. Until and unless Trump starts making many deals to largely end the tariffs, it is unlikely the administration will be able to calm the horses. I can’t measure this with calipers, but everything I know about everything suggests that the flood-the-zone Sunday show appearances from administration officials made things worse not better, with massive X, media, and private sector flyspecking of — and mocking of — the comments that were made.

To choose one of many, many examples, Scott Bessent’s attempt to reassure folks that those at or near retirement will be a-ok is unlikely to be a balm to those many, many, many retirees and near retirees are who, in fact, already panicking.

6. Equally certain: Trump’s Sunday remarks (on social media and to the pool flying back on Air Force One to DC) have not reassured and will not reassure. No normal president would be allowed by his staff to spend a let-them-eat-cake weekend playing golf and fundraising while economic chaos he unilaterally unleashed engulfed the planet.

The president has a scheduled 2:30pm press conference with Bibi today at the White House. Watch the market split screen during that effort.

7. The world and U.S. market players are waiting on

a. How bad will the S&P, Dow, and other indicators be today?

b. Will Trump make some deals quick with countries and companies?

c. Will Republicans in Congress, privately and publicly more restive by the moment, intervene?

d. What will Jamie Dimon say in his annual letter today?

e. Reuters:

Ministers in the European Union, which has been divided on how strongly to punch back against Trump without risking more pain for their own companies and consumers, are meeting on Monday as they seek to form a united front.

Goldman Sachs raised the odds of a U.S. recession to 45% in the next 12 months, joining other investment banks in revising their forecast. JPMorgan economists now estimate the tariffs pushing the U.S. economy into a 0.3% contraction, down from an earlier estimate of 1.3% growth of gross domestic product.

8. Expect a lot more of stuff like this, as tariff super skeptics look for ways to explain what appears to them to be the greatest act of economic and political suicide of all time:

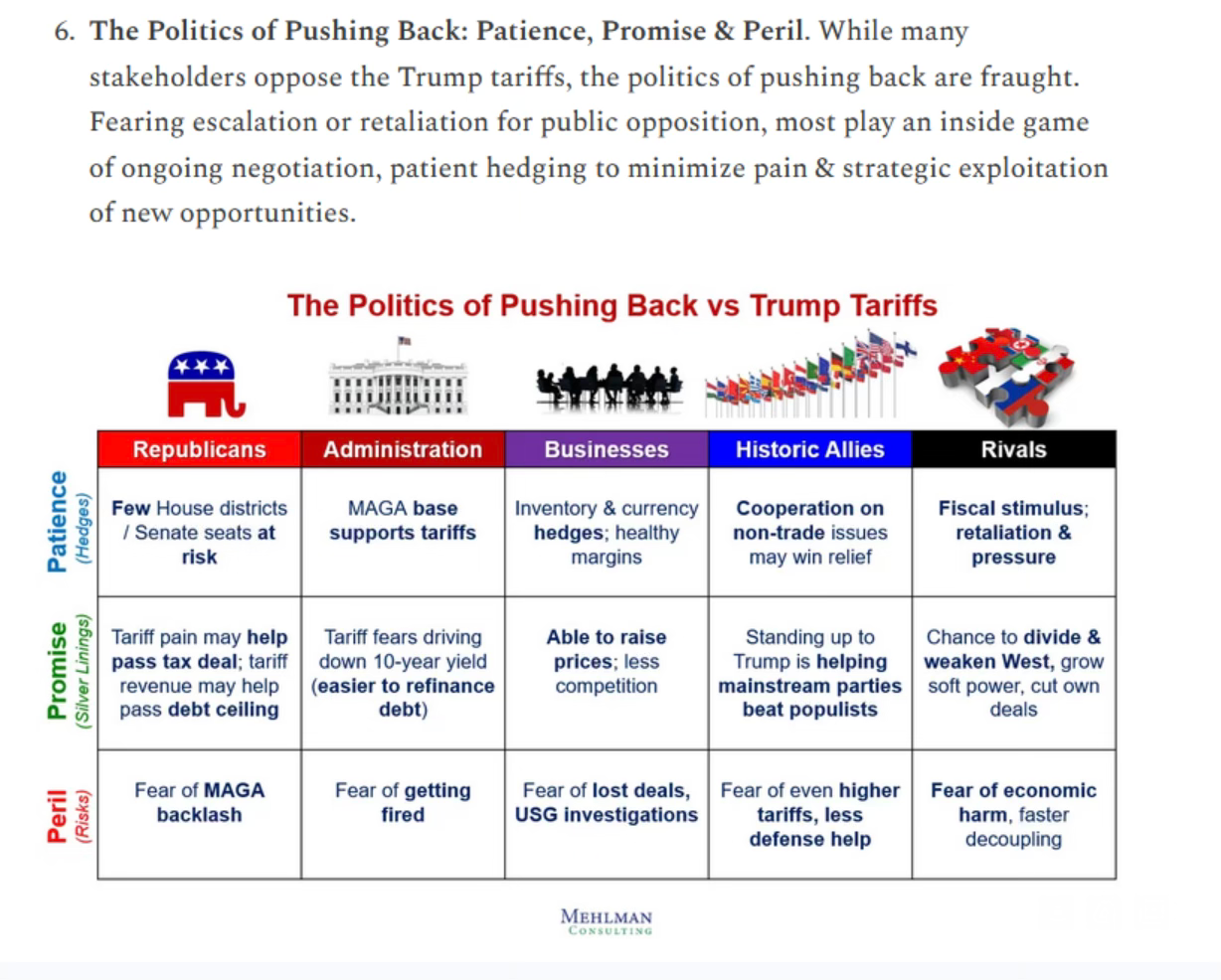

9. Washington policy strategist Bruce Mehlman this week went deep on where Trump tariffs are headed… whether they’re the means to an end (prelude to new deals), or the end game themselves (no deals, no off-ramps). While he sees few beyond the MAGA base happy about the trade war, most take a cautious approach to criticizing the President, hedging to survive the disruption while looking for silver linings to exploit.

10. On the other hand, Trump believes in tariffs, thinks it is always darkest before the dawn, and has the backing of tens of millions of Americans who believe only extreme, radical, fundamental change can restore the nation’s capacity to produce good paying jobs for our children and grandchildren. Trump is already facing more opposition and rejection of his plan than he could have possibly imagined. This level of conflict, hostility, and resistance, including from many of the president’s allies, is simply not sustainable on any basis beyond a fortnight at most.

Something has to give by, say, Wednesday.

And it will.

What that something will be, however, is not yet clear.

To be continued….